Hey!

Welcome to another edition of our Nasdaq-100 Weekly roundup. This week, we've seen semiconductors creating ripples across the entire index.

Table of Contents:

Winners, Losers, Most Active

Behind the Market Movers

QQQ Short-Term Analysis

[Premium] Potential QQQ Plays

Winners

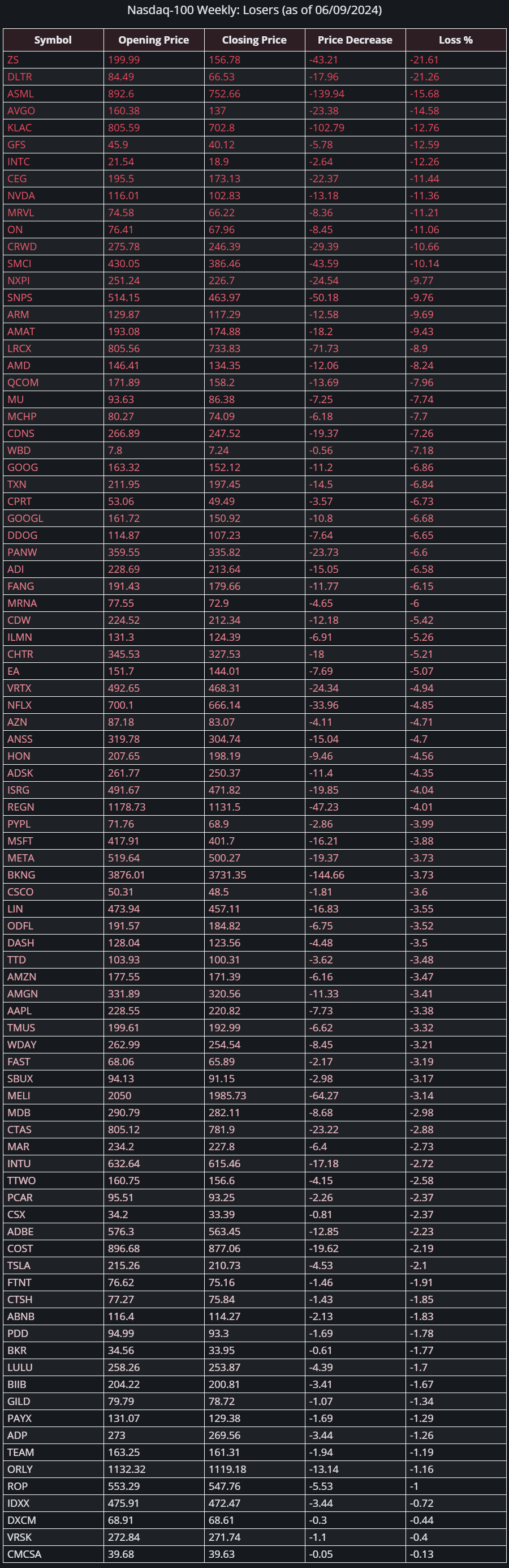

Losers

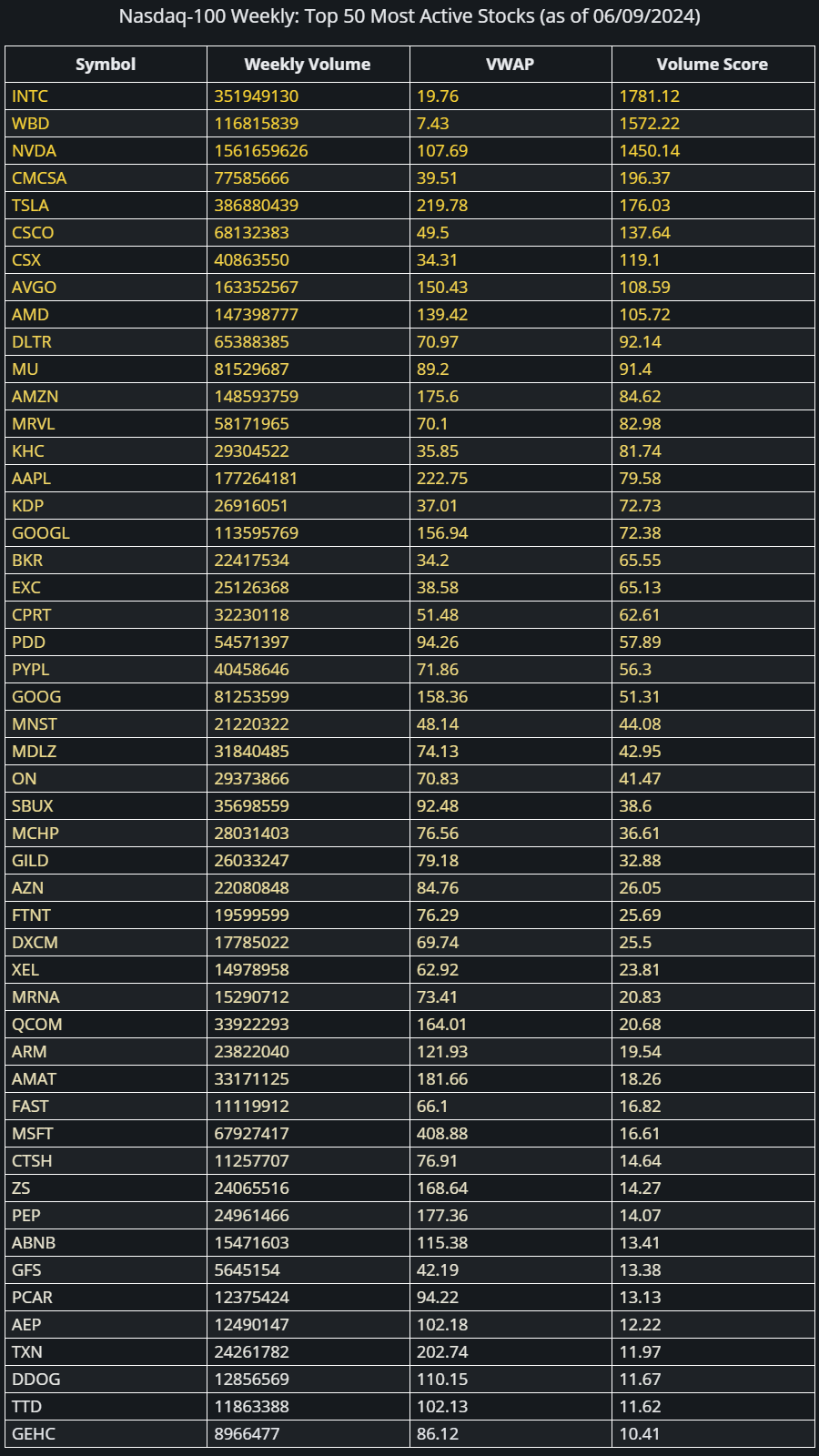

Most Active

Behind the Market Movers

Semiconductor stocks are taking a beating, dragged down by heavyweights like NVIDIA, AMD, and Broadcom. We're looking at the worst week for chip stocks in over four years.

The Nasdaq 100 is eyeing its worst week in two years. We’re bearing the brunt of the semiconductor slump and broader market jitters.

With Friday's jobs report, the economy can't decide if it wants to be hot or cold. This uncertainty is causing traders to frantically adjust their rate cut expectations, sending ripples through tech stocks. This constant recalibration is keeping the sector on its toes.

While most tech stocks are taking a beating, Tesla's showing some unexpected strength.

NVIDIA has lost a staggering $279 billion in market cap, an overreaction, perhaps, but also a reality check for AI valuations.

So, a perfect storm of semiconductor woes, jobs data uncertainty, and valuation reality checks has arrived at the Nasdaq 100. It's like the market decided to play all its wild cards at once. We're seeing a clear rotation from high-flying tech into safer consumer staples. But with chip stocks all over our most active list, it looks like traders are trying to catch falling knives. This volatility is the market trying to price in a world where AI hype meets economic reality.

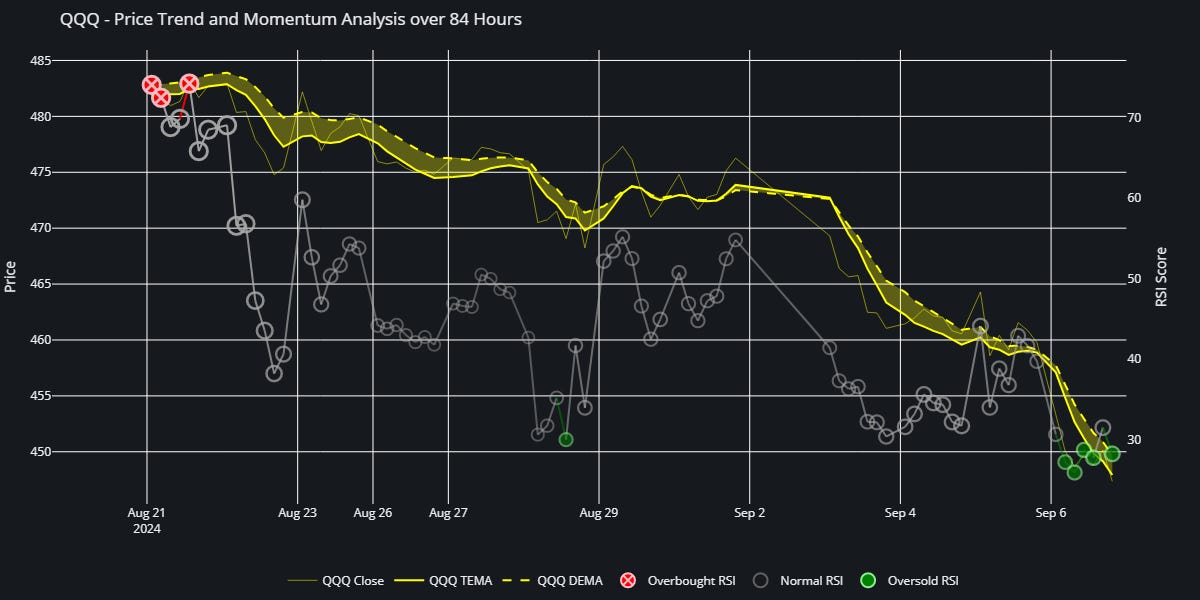

QQQ Short-Term Analysis 🟩

(Don't understand the chart? I explain how it works in this post.)

QQQ closed at 447.36 on September 6, down from 476.27 on August 30. That's a significant 6.07% drop in a week.

For now, technical indicators are painting a bearish picture, but there’s a potential twist that I see: the oversold conditions could set the stage for a short-term technical bounce.

Key Levels to Watch:

Support: 447.36 (current close), 446.00 (potential dip level)

Resistance: 449.72 (DEMA), 450.00 (psychological level), 453.34 (recent resistance)

Of course, we need to remember that any rallies could face selling pressure unless we see a significant change in market sentiment.

Below, in the Members Only section, I discuss my further analysis of QQQ with potential plays. If you can't access it, consider getting a 7-day free trial (no credit card required!):

Members Only

Potential QQQ Plays

Given the current market conditions and our analysis, here are some potential plays for QQQ:

Conservative Approach:

Keep reading with a 7-day free trial

Subscribe to NASDUCK to keep reading this post and get 7 days of free access to the full post archives.